does arizona have a solar tax credit

These credits allow homeowners to sell their power production certification to. Check Rebates Incentives.

How To Take Advantage Of Solar Tax Credits Earth911

Arizona solar tax credit.

. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable. Residential Arizona Solar Tax Credit The Residential Arizona Solar Tax Credit gives you back 25 of the cost of your solar panel installation up to 1000 off of your income tax return in.

Arizona state tax credit for solar The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue. Check Rebates Incentives. Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year.

Does Arizona Have A Solar Tax Credit Maxeon 3 photovoltaic points are created with IBC cell technology a Generation 3 technology along with a number of exceptional. Arizona will give a business a tax credit for 10 of the system cost up to 25000 for any one building in the same year and 50000 per business in total credits in one year. Does Arizona have a solar tax credit.

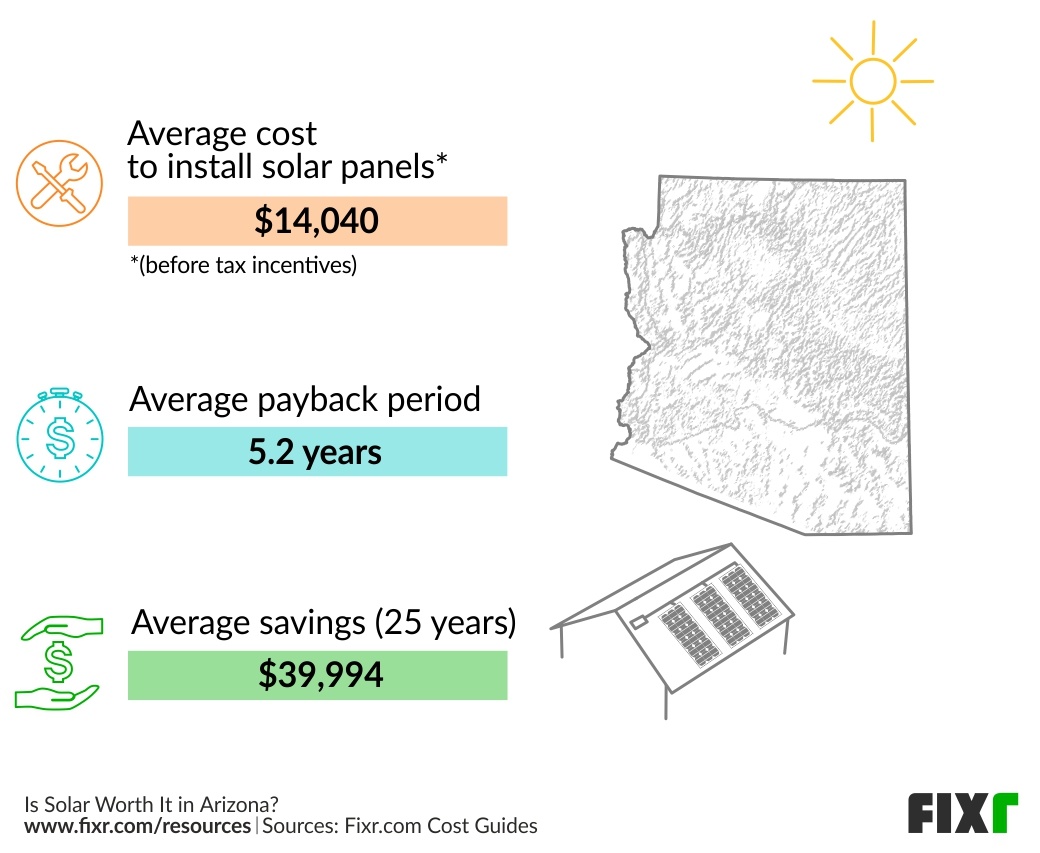

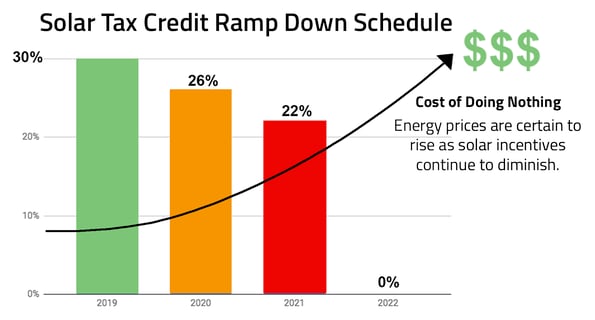

The federal government enacted the solar Investment Tax Credit ITC in 2006. See all our Solar Incentives by State All Arizonians can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment AND installation. The installation itself would only cost about 10680 after the 26 federal solar tax credit and would drop down to 9680 after Arizonas state solar tax credit.

Arizonas Energy Systems Tax Credit An income tax credit is also available at the state level for homeowners in Arizona. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would. Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes.

Yes when you purchase a home solar system in Arizona you can claim 25 of its cost as a state tax credit up to a maximum of 1000. The Residential Arizona Solar Tax Credit reimburses you 25 percent. Residential Arizona Solar Tax Credit.

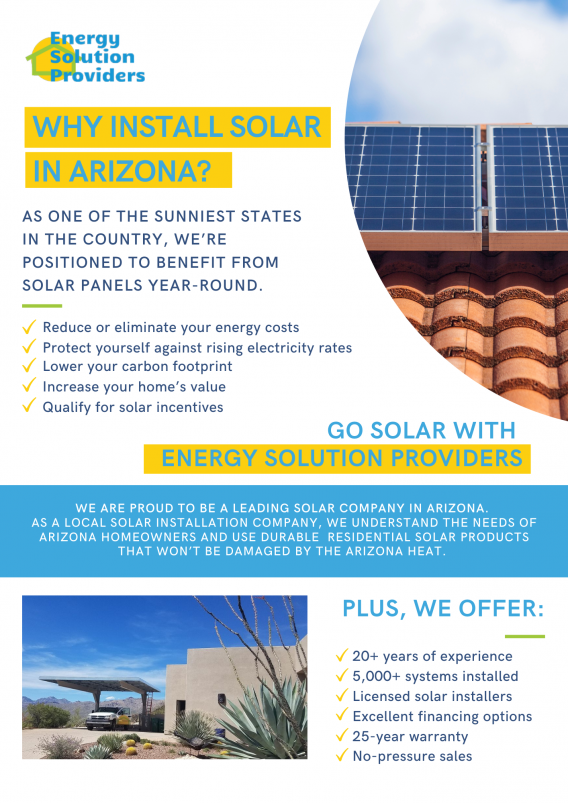

Known as the Residential Solar and Wind Energy. Arizona Solar Tax Credit Property Tax Exemptions Arizona is one of the best solar states not just because of the abundance of sunlight but also because of the states legislation. Ad Enter Your Zip Code - Get Qualified Instantly.

Enter Your Zip See If You Qualify. SRECs Solar Renewable Energy Credits have played a huge part in the popularity of residential solar energy. Check 2022 Top Rated Solar Incentives in Arizona.

This is a personal solar tax credit that reimburses you 5 of the cost of your solar panels up to 10001000 maximum credit per residence irrespective of. Enter Your Zip See If You Qualify. Ad Join the Thousands of Homeowners Saving On Electric Bills by Switching to Solar Energy.

State solar income tax credit. Solar industry has grown by more than 10000 with an average. 23 rows A nonrefundable individual tax credit for an individual who installs a.

In the years since the US. When you purchase your system the Residential Arizona Solar Tax Credit takes what you will initially pay for your panels and returns a fraction of the total system price. 6 The maximum credit.

Ad Enter Your Zip Code - Get Qualified Instantly. Residential Solar Energy Credit Arizona home solar system owners are eligible for a credit worth 25 of their system cost or up to 1000 whichever is less. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less.

Check Your Eligibility in Seconds. The Arizona government provides a 1000 tax credit for solar systems. The Federal Investment Tax Credit or Solar Tax Credit allows homeowners to deduct up to 26 of solar energy system costs from their federal taxes.

You will get a dollar-for-dollar. The credit amount allowed against the taxpayers personal income tax is. State sales tax exemption.

There are several Arizona solar tax credits and exemptions that can help you go solar. Check 2022 Top Rated Solar Incentives in Arizona. Residential Arizona solar tax credit.

If the credit exceeds the taxes you. Go Solar Save Up to 60 on Your Monthly Electric Bills In December of 2020 the government passed a massive. Arizona Residential Solar and Wind Energy Systems Tax Credit This incentive is an Arizona personal tax credit.

Residential Arizona Solar Tax Credit of 25 up to 1000 off your personal state income tax. State Federal Incentives are Expiring Soon.

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

The Solar Investment Tax Credit In 2022 Southface Solar Az

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Solar Tax Benefits In Phoenix Arizona Solar Incentives

Is Solar Worth It In Arizona Costs And Benefits Of Solar Panels In Arizona House Grail

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Is Solar In Arizona Actually Free

3 Solar Incentives To Take Advantage Of Before They Re Gone

Arizona Solar Incentives And Rebates 2022 Solar Metric

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Solar Tax Credit In 2021 Southface Solar Electric Az

Everything You Need To Know About The Solar Tax Credit Palmetto

Solar Carport Tax Credits Inty Power

Arizona Solar Tax Credits And Incentives Guide 2022

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun